A strong accounting resume is ideal if you want the accounting role you are looking for. You can stand out from other applicants and show potential employers why you’re the ideal candidate for their accounting position by showing your accounting knowledge and experience.

The skills and experience on your resume must be relevant to the job you’re applying for.

Your accounting resume should also showcase your achievements in the accounting field and any projects you’ve managed.

Tailor your resume to each job you’re applying for and ensure it is free of errors. For example, if you have applied for a financial accountant, highlight experience related to financial reporting and analysis.

Accounting Resume Examples

Accounting resumes should highlight relevant skills that would make you an asset to an accounting department.

However, accounting is such a broad subject that many roles fit under the umbrella. So no two accountants will have the same type of resume.

Cater your accounting resume to fit the position you’re applying for and your experience. Review common accounting jobs and their resume below.

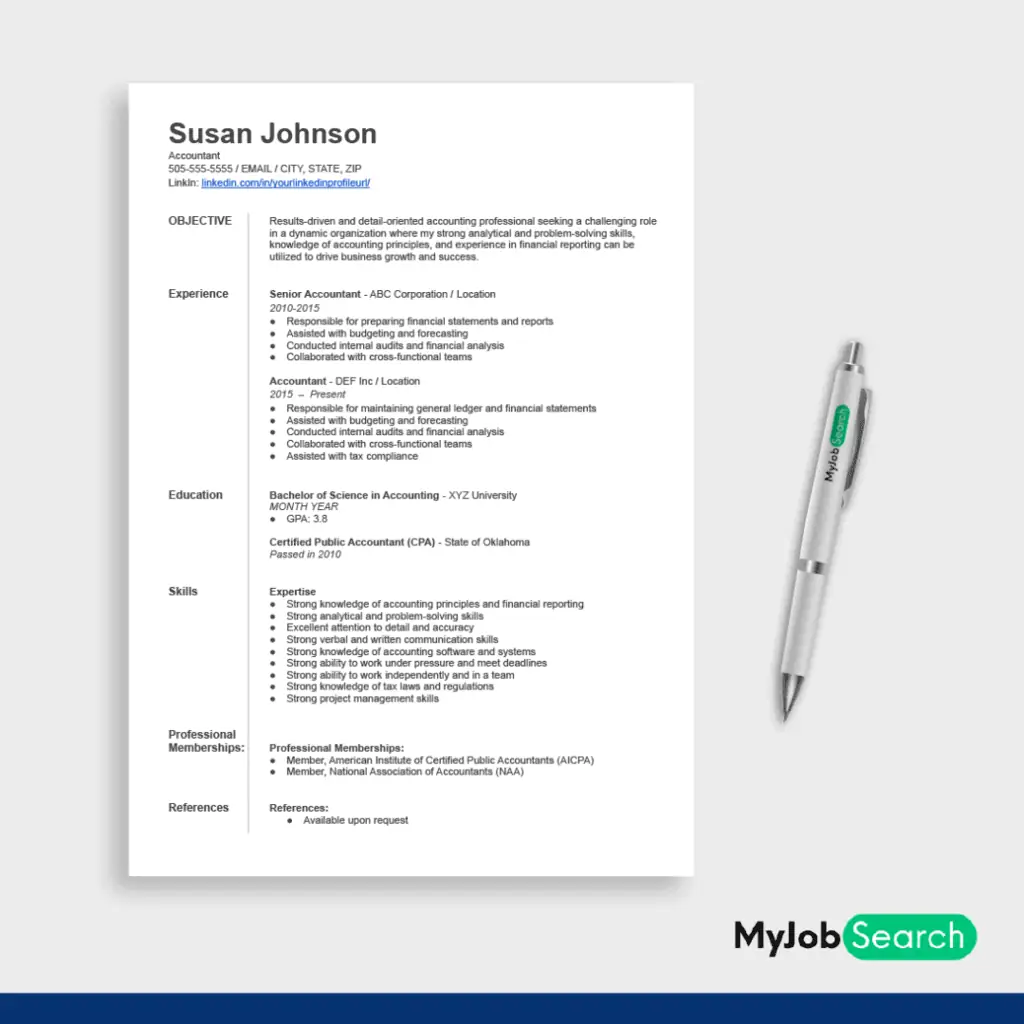

1. General Accounting Resume Example

Some begin an accounting career as a junior accountant or an accounting clerk. Those in these roles will do a little of everything to support the accounting department of a business.

Larger businesses will have very large accounting departments with sub-departments that manage a section of the accounting cycle.

Why We Suggest this Resume

A generic accountant resume is great for those without a high level of specialization. This resume highlights the candidate's wide variety of accounting-related skills and experience.

- Type of Resume: General Accounting Resume

- Best For: Accountants with day-to-day accounting responsibilities

Why This Resume Works

This resume highlights many key skills and experiences accounting managers need when filling an accountant role.

Since the accounting cycle is very broad with many moving parts, this resume showcases experience in multiple areas of accounting, such as accounts receivable, accounts payable, and general ledger accounting.

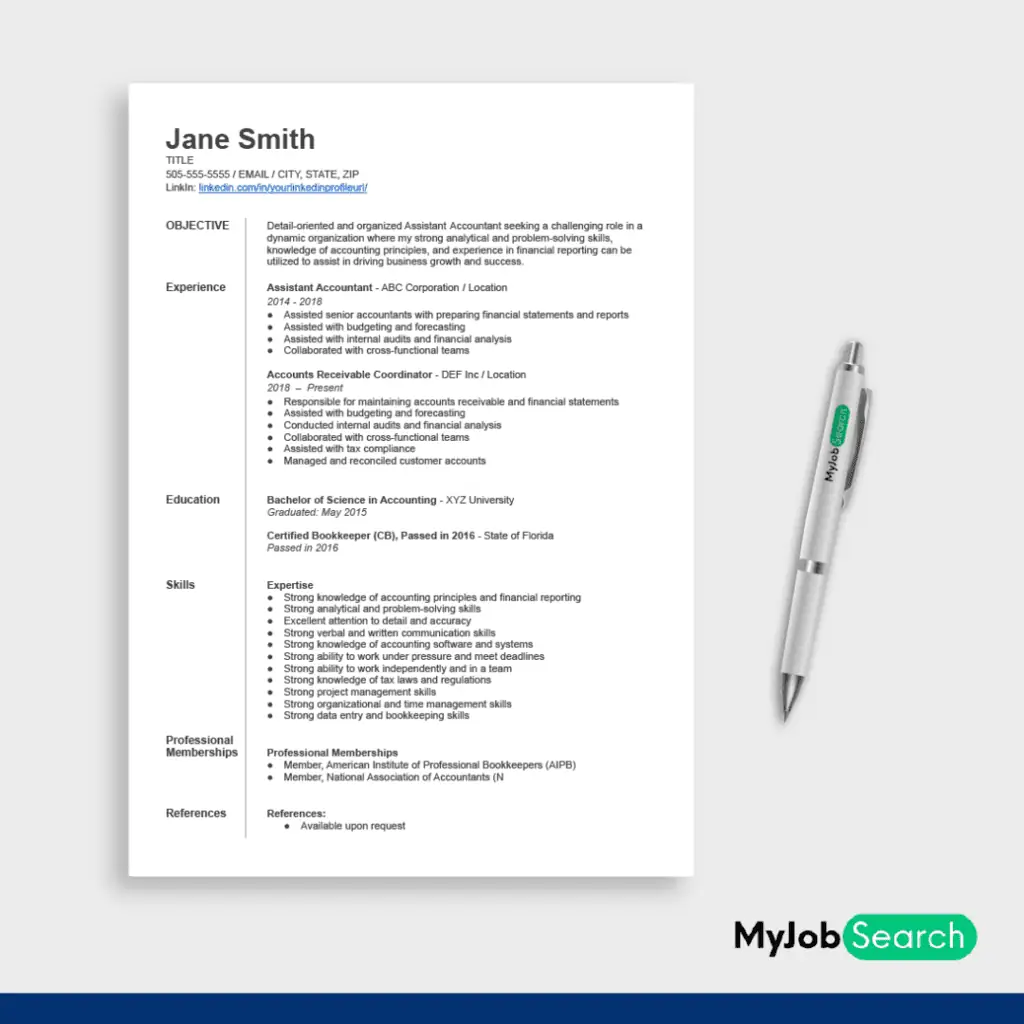

2. Assistant Accounting Resume Examples

Accounting assistants perform transactional tasks to support accountants with the accounting cycle.

They are assigned projects that may require some analytical skills, but they do not sign off on final accounting reports and deliverables the way an accountant does.

Why this Resume Works

This resume works for an accounting assistant because it demonstrates expertise in support roles that require deep knowledge of accounting principles.

Although important, no leadership skills are mentioned, but not required as an accounting assistant.

The accounting assistant resume focuses on skills and experience over education.

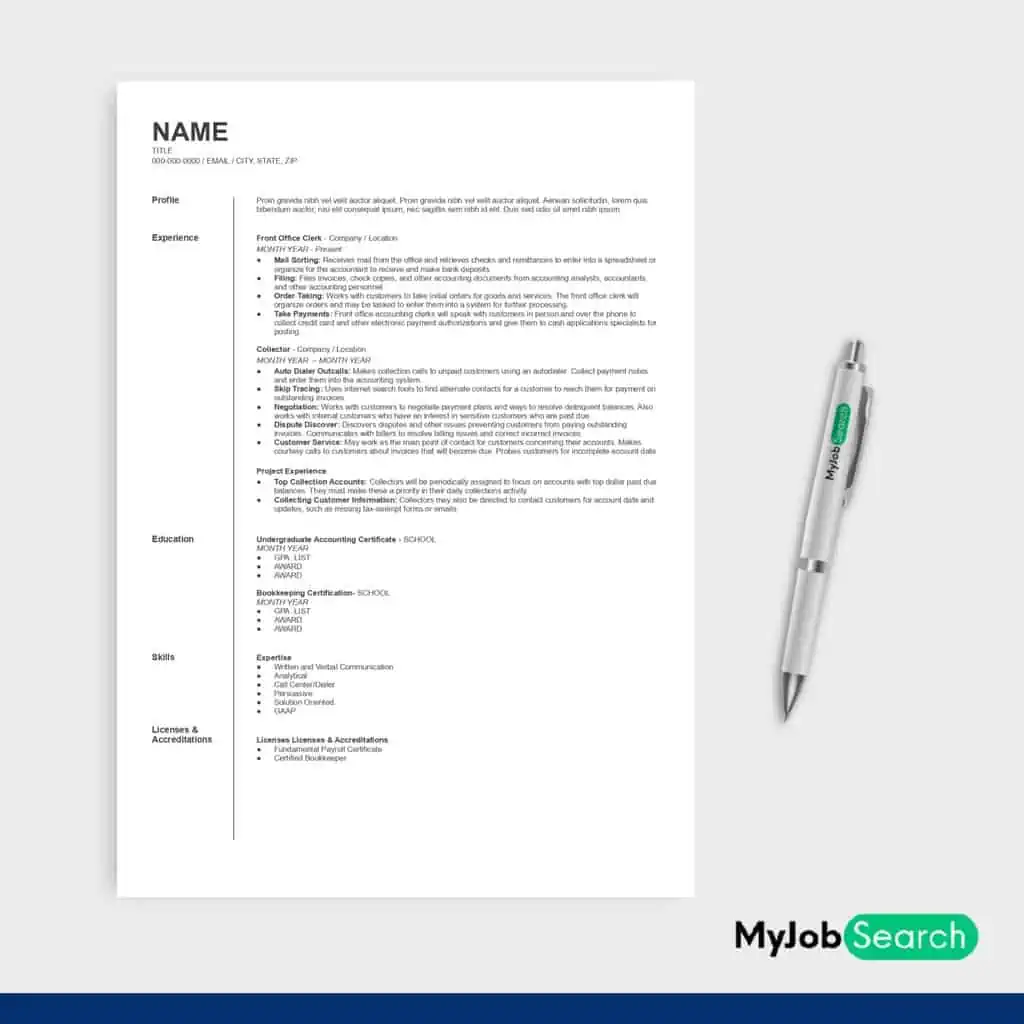

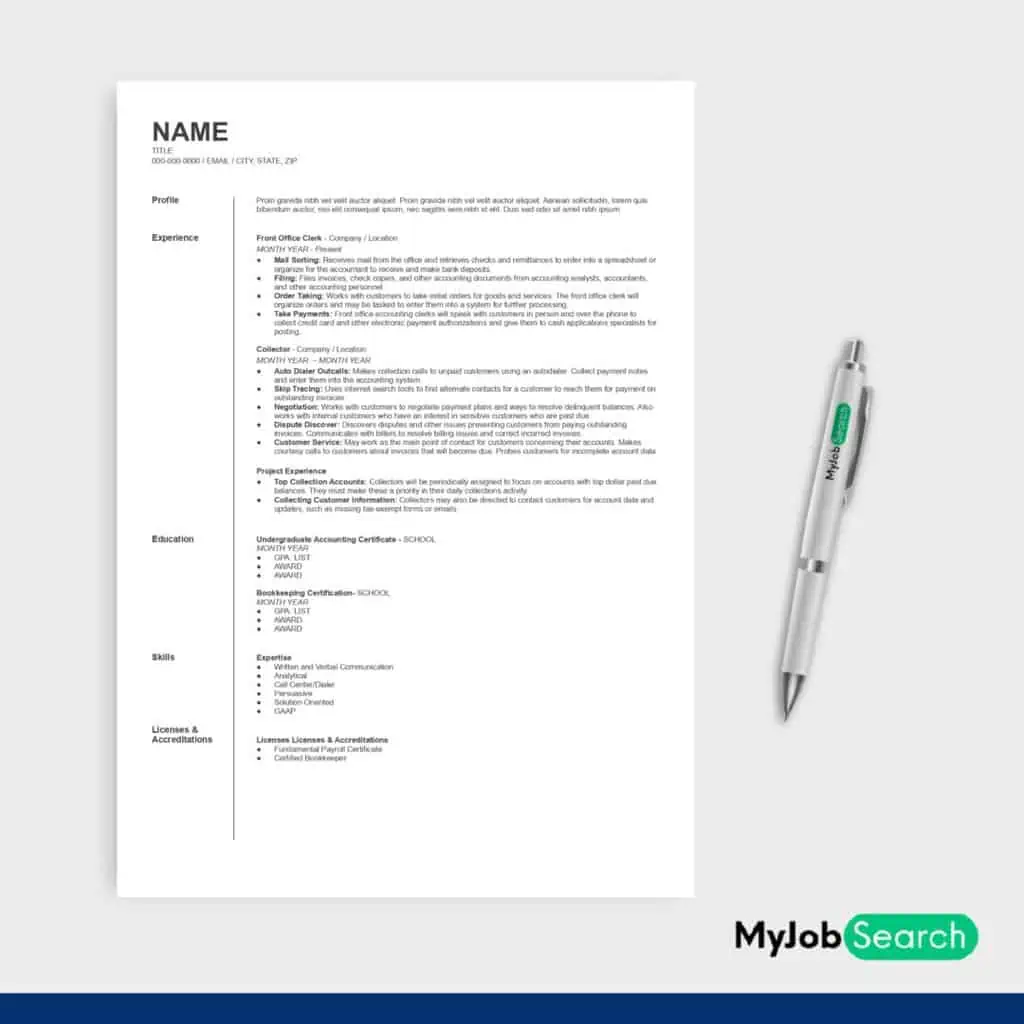

Accounting Clerk Resume Examples

The accounting clerk role is an administrative support role that supports accounting departments with administrative and clerical tasks.

These roles are typically entry-level and require a basic understanding of accounting principles.

Why We Suggest this Resume

As an accountant seeking an entry-level job, it is important to showcase administrative support and clerical skills. This resume highlights these skills to help you stand out from the rest.

- Type of Resume: Accounting Clerk Resume Examples

- Best For: Accountants looking for an entry-level job

Work Experience 1 – Front Office Clerk

- Mail Sorting: Receives mail from the office and retrieves checks and remittances to enter into a spreadsheet or organize for the accountant to receive and make bank deposits.

- Filing: Files invoices, check copies, and other accounting documents from accounting analysts, accountants, and other accounting personnel.

- Order Taking: Works with customers to take initial orders for goods and services. The front office clerk will organize orders and may be tasked to enter them into a system for further processing.

- Take Payments: Front office accounting clerks will speak with customers in person and over the phone to collect credit card and other electronic payment authorizations and give them to cash applications specialists for posting.

Work Experience 2 – Collector

- Auto Dialer Outcalls: Makes collection calls to unpaid customers using an autodialer. Collect payment notes and enter them into the accounting system.

- Skip Tracing: Uses internet search tools to find alternate contacts for a customer to reach them for payment on outstanding invoices.

- Negotiation: Works with customers to negotiate payment plans and ways to resolve delinquent balances. Also works with internal customers who have an interest in sensitive customers who are past due.

- Dispute Discover: Discovers disputes and other issues preventing customers from paying outstanding invoices. Communicates with billers to resolve billing issues and correct incorrect invoices.

- Customer Service: May work as the main point of contact for customers concerning their accounts. Makes courtesy calls to customers about invoices that will become due. Probes customers for incomplete account data.

Projects

- Top Collection Accounts: Collectors will be periodically assigned to focus on accounts with top dollar past due balances. They must make these a priority in their daily collections activity.

- Collecting Customer Information: Collectors may also be directed to contact customers for account data and updates, such as missing tax-exempt forms or emails.

Skills

- Written and Verbal Communication

- Analytical

- Call Center/Dialer

- Persuasive

- Solution Oriented

- GAAP

Education

- Undergraduate Accounting Certificate

- Bookkeeping Certification

- Associates Degree in Accounting or Business

Licenses and Accreditations

- Fundamental Payroll Certificate

- Certified Bookkeeper

Why this Resume Works

This resume works for an accounting clerk because it shows the vast experience the applicant has in the field of accounting.

The applicant has been working in support roles that have shown the person the basic principles and concepts that the accounting field offers.

Communication and problem solving are the principal skills and the most important ones to be adept at the position.

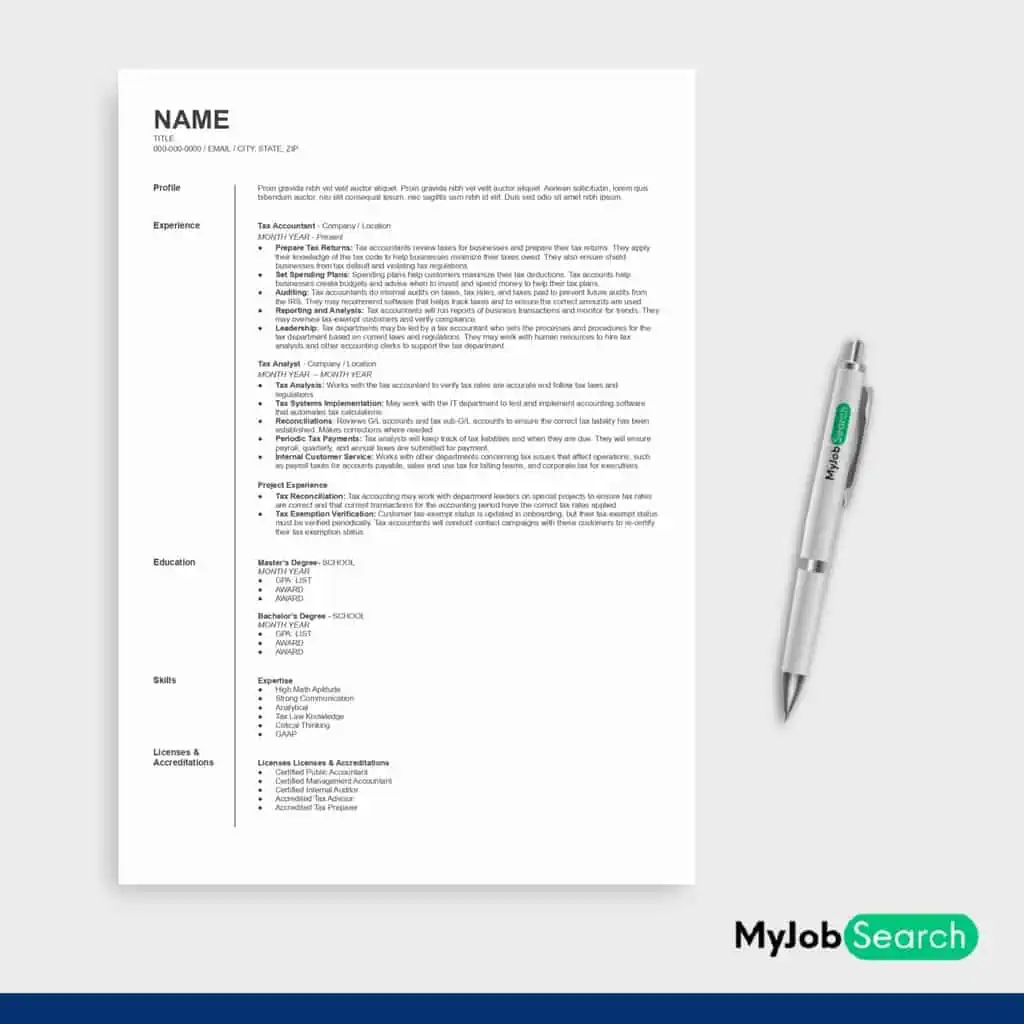

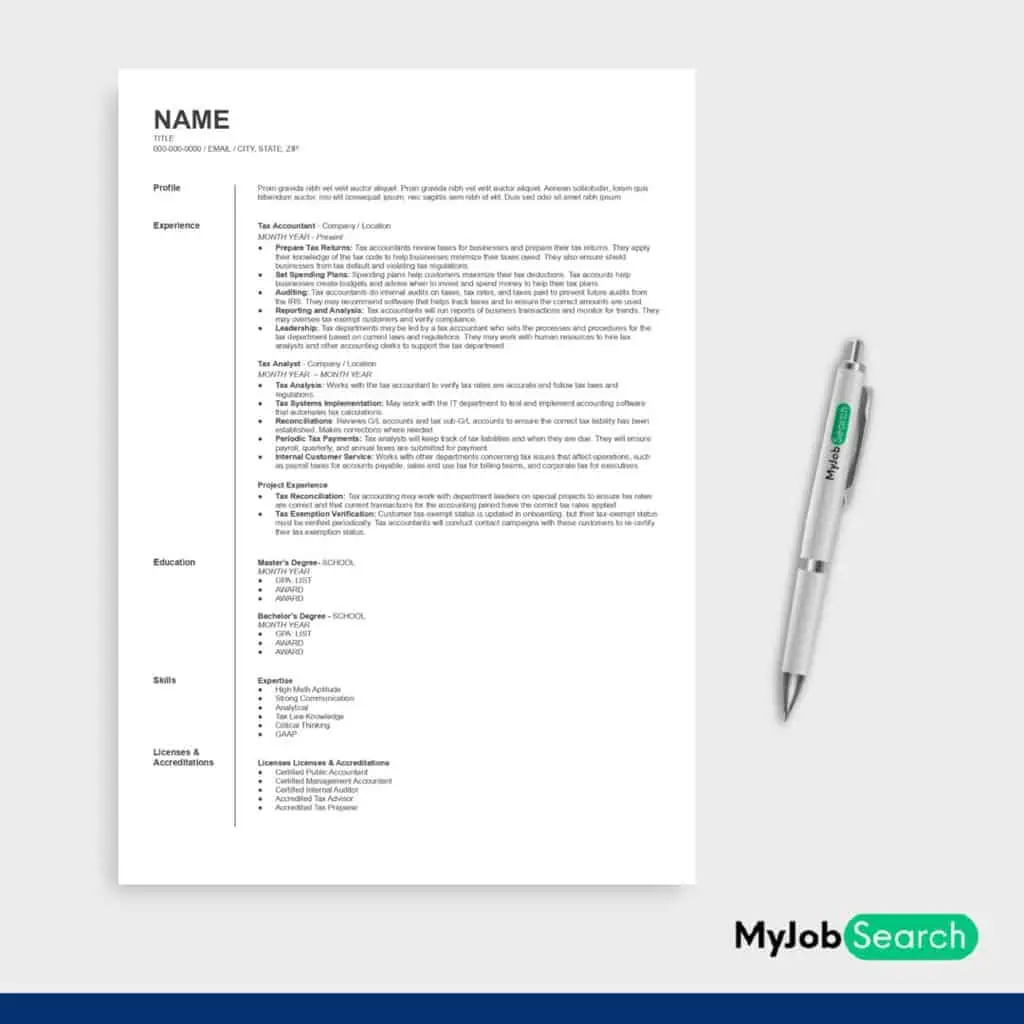

Tax Accounting Resume Examples

A Tax accounting resume should showcase an extensive knowledge of tax laws and regulations and the ability to analyze financial data.

Work Experience 1 – Tax Accountant

- Prepare Tax Returns: Tax accountants review taxes for businesses and prepare their tax returns. They apply their knowledge of the tax code to help businesses minimize their taxes owed. They also ensure shield businesses from tax default and violating tax regulations.

- Set Spending Plans: Spending plans help customers maximize their tax deductions. Tax accounts help businesses create budgets and advise when to invest and spend money to help their tax plans.

- Auditing: Tax accountants do internal audits on taxes, tax rates, and taxes paid to prevent future audits from the IRS. They may recommend software that helps track taxes and to ensure the correct amounts are used.

- Reporting and Analysis: Tax accountants will run reports of business transactions and monitor for trends. They may oversee tax-exempt customers and verify compliance.

- Leadership: Tax departments may be led by a tax accountant who sets the processes and procedures for the tax department based on current laws and regulations. They may work with human resources to hire tax analysts and other accounting clerks to support the tax department.

Work Experience 2 – Tax Analyst

- Tax Analysis: Works with the tax accountant to verify tax rates are accurate and follow tax laws and regulations.

- Tax Systems Implementation: May work with the IT department to test and implement accounting software that automates tax calculations.

- Reconciliations: Reviews G/L accounts and tax sub-G/L accounts to ensure the correct tax liability has been established. Makes corrections where needed.

- Periodic Tax Payments: Tax analysts will keep track of tax liabilities and when they are due. They will ensure payroll, quarterly, and annual taxes are submitted for payment.

- Internal Customer Service: Works with other departments concerning tax issues that affect operations, such as payroll taxes for accounts payable, sales and use tax for billing teams, and corporate tax for executives.

Projects

- Tax Reconciliation: Tax accounting may work with department leaders on special projects to ensure tax rates are correct and that current transactions for the accounting period have the correct tax rates applied.

- Tax Exemption Verification: Customer tax-exempt status is updated in onboarding, but their tax-exempt status must be verified periodically. Tax accountants will conduct contact campaigns with these customers to re-certify their tax exemption status.

Skills

- High Math Aptitude

- Strong Communication

- Analytical

- Tax Law Knowledge

- Critical Thinking

- GAAP

Education

- Bachelor’s Degree: In accounting, finance or business

- Master’s Degree: In accountancy, finance, or business administration

Licenses and Certifications

- Certified Public Accountant

- Certified Management Accountant

- Certified Internal Auditor

- Accredited Tax Advisor

- Accredited Tax Preparer

Why This Resume Works

Tax accounting is heavy in tax knowledge and analysis.

This resume highlights skills and experience that caters to resolving tax discrepancies through research and performing reporting and other research related to a business’s tax liability.

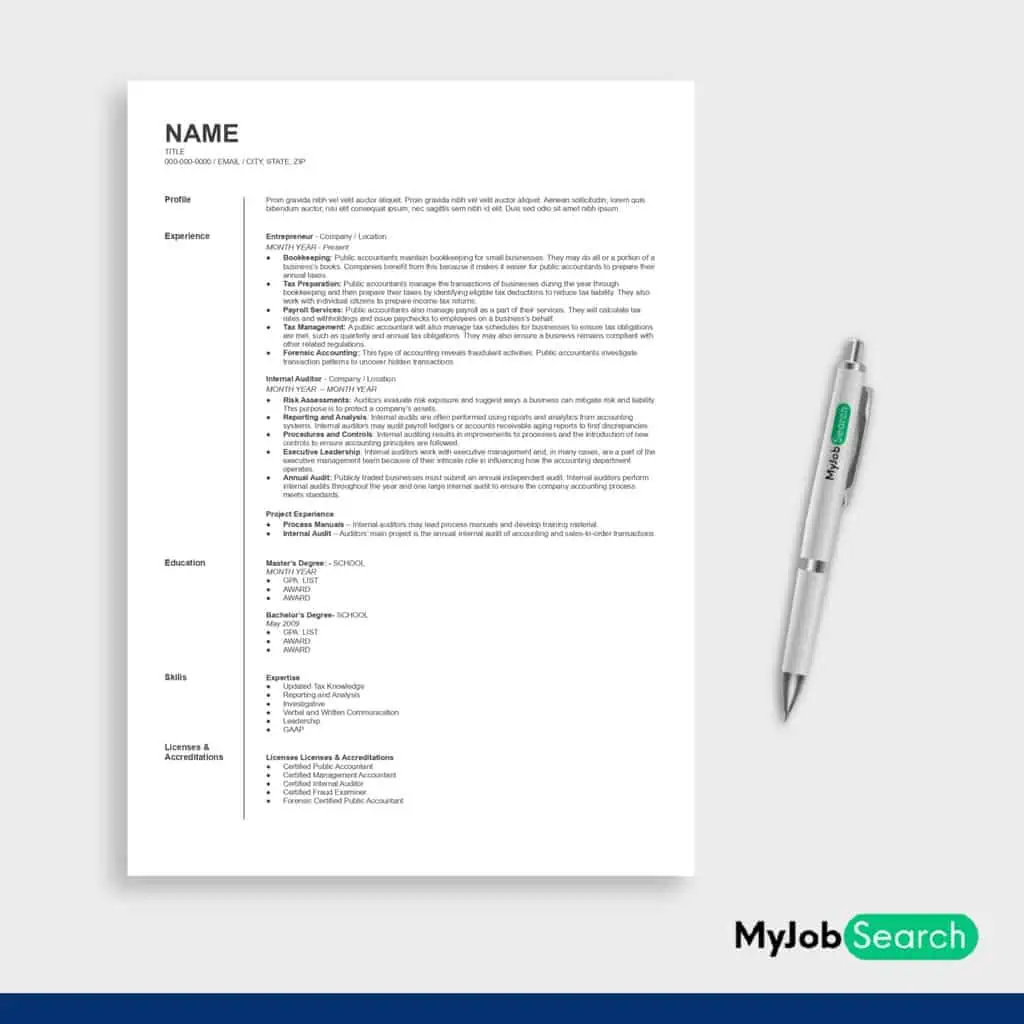

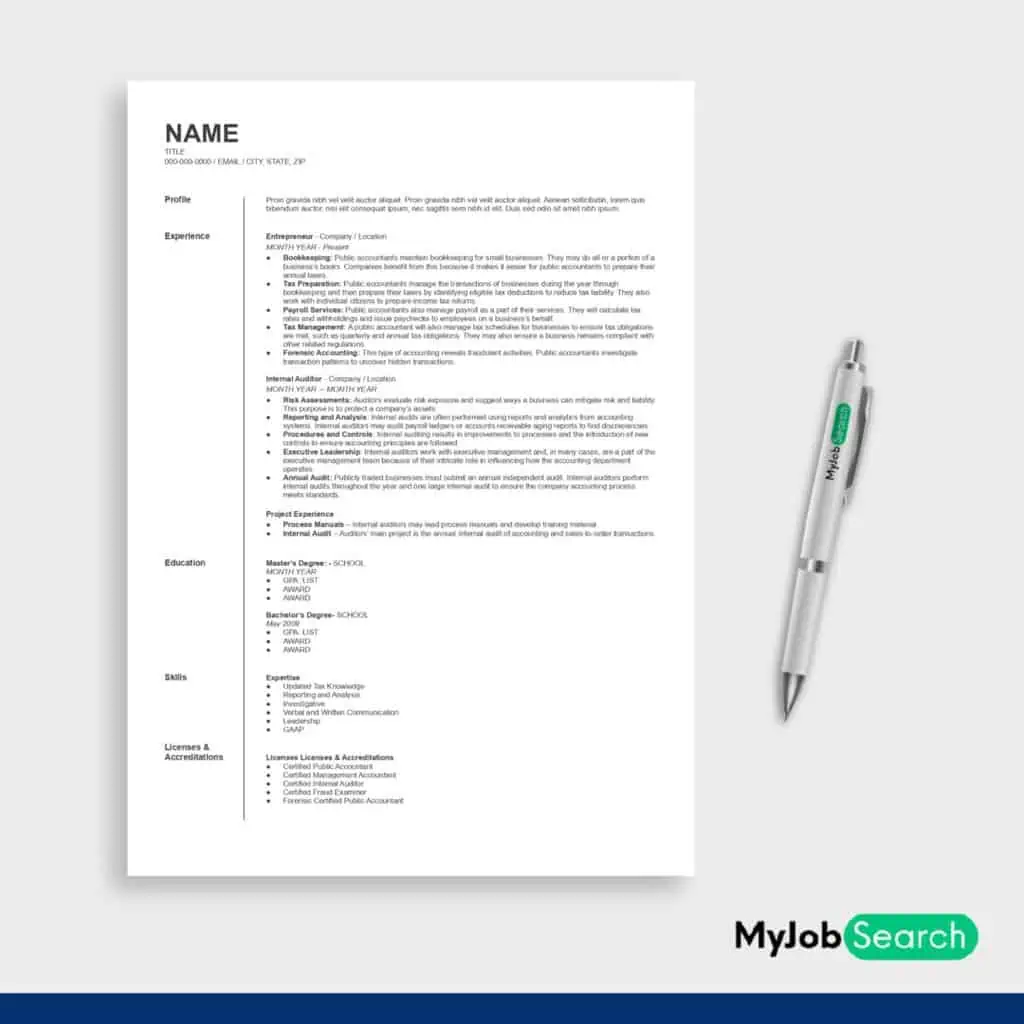

Public Accounting Resume Examples

Public accountant resumes showcase accounting expertise in public accounting and working with the general public on accounting matters.

Public accountants usually prepare individual tax returns and help small businesses with their tax filings.

The public accountant’s resume will have certifications highlighting the candidate’s accounting authority.

Work Experience 1 – Entrepreneur

- Bookkeeping: Public accountants maintain bookkeeping for small businesses. They may do all or a portion of a business’s books. Companies benefit from this because it makes it easier for public accountants to prepare their annual taxes.

- Tax Preparation: Public accountants manage the transactions of businesses during the year through bookkeeping and then prepare their taxes by identifying eligible tax deductions to reduce tax liability. They also work with individual citizens to prepare income tax returns.

- Payroll Services: Public accountants also manage payroll as a part of their services. They will calculate tax rates and withholdings and issue paychecks to employees on a business’s behalf.

- Tax Management: A public accountant will also manage tax schedules for businesses to ensure tax obligations are met, such as quarterly and annual tax obligations. They may also ensure a business remains compliant with other related regulations.

- Forensic Accounting: This type of accounting reveals fraudulent activities. Public accountants investigate transaction patterns to uncover hidden transactions.

Work Experience 2 – Internal Auditor

- Risk Assessments: Auditors evaluate risk exposure and suggest ways a business can mitigate risk and liability. This purpose is to protect a company’s assets.

- Reporting and Analysis: Internal audits are often performed using reports and analytics from accounting systems. Internal auditors may audit payroll ledgers or accounts receivable aging reports to find discrepancies.

- Procedures and Controls: Internal auditing results in improvements to processes and the introduction of new controls to ensure accounting principles are followed.

- Executive Leadership: Internal auditors work with executive management and, in many cases, are a part of the executive management team because of their intricate role in influencing how the accounting department operates.

- Annual Audit: Publicly traded businesses must submit an annual independent audit. Internal auditors perform internal audits throughout the year and one large internal audit to ensure the company accounting process meets standards.

Projects

- Process Manuals – Internal auditors may lead process manuals and develop training material.

- Internal Audit – Auditors’ main project is the annual internal audit of accounting and sales-to-order transactions.

Skills

- Updated Tax Knowledge

- Reporting and Analysis

- Investigative

- Verbal and Written Communication

- Leadership

- GAAP

Education

- Bachelor’s Degree: A bachelor’s degree in accounting, finance, and sometimes business is acceptable.

- Master’s Degree: A master’s degree in accountancy or business administration is acceptable.

Licenses and Certifications

- Certified Public Accountant

- Certified Management Accountant

- Certified Internal Auditor

- Certified Fraud Examiner

- Forensic Certified Public Accountant

Why This Resume Works

This resume works because it includes several highly specialized skill sets required of a public accountant.

It differentiates the professional expectations and corporate influence a professional accountant has in a business compared to a non-certified accountant.

Common Skills & Action Verbs to Include on an Accounting Resume

There are two types of skills you should list on your resume: hard and soft skills.

Hard skills are skills you learn through formal education such as working Excel, Access, and ERP systems.

Soft skills are skills that reflect your interpersonal growth such as customer service, time management, and attention to detail.

Common Skills for Accounting Resumes

- GAAP

- Mathematical Comprehension

- Data Analysis

- Negotiation abilities

- Proficiency in Accounting Software (Quickbooks, SAP)

- Time Management

- Empathy

- Organizational Management

- Team-building

- Quick learning

- Active listening

- Conflict resolution

- Technology handling

- Easy adaptability to changes

- Patience

Incorporating numbers and percentages into your resume can help to demonstrate your experience with budgeting, forecasting, and handling payroll.

Common Action Verbs for Accounting Resumes

For tax accountants, it’s important to show an understanding of the tax code and how it applies to individuals and businesses.

You can do this by using action verbs.

- Assessed

- Evaluated

- Researched

- Analyzed

- Trained

- Communicated

- Organized

- Reconciled

- Audited

- Reported

- Prepared

When using these verbs, marry them with accounting principles and skill sets to demonstrate your ability to apply accounting expertise in your work.

Tips for Writing a Better Accounting Resume

Research the company to understand what they are looking for in their ideal candidate. Then, tailor your resume to fit the qualifications they desire.

Don’t Omit your Qualifications

Be sure to list any qualifications specific to the accounting position you are applying for, such as knowledge of accounting practices, proficiency in accounting software like QuickBooks, NetSuite, and Oracle, and the ability to prepare financial statements.

In addition, make sure to draw connections between your previous work experience and the desired role.

The best way to do this is by creating an engaging objective statement that discusses your experience and accomplishments relevant to the role you are applying for.

Skills and qualifications should be highlighted and formatted so hiring managers can easily find them.

Some recommendations include skills shortly after your objective statement so that hiring managers can quickly see what skills they should ask questions about.

Your work experience section does not always showcase skills in a way that stands out easier to hiring managers.

Be True to Yourself, or Don’t Lie

Others skills accounting hiring managers seek on an accounting resume is knowledge of accounting principles.

The GAAP is the most commonly desired set of accounting principles managers want to see you master.

You may also include other related compliance knowledge, such as internal auditing and the Sarbanes Oxley (SOX).

Do not list these principles if you do not know them well enough to discuss them if asked about them in an interview.

Also, display projects you’ve worked on. Use the STAR method to determine the problem your project resolved and the results quickly. This will help demonstrate how your skills are transferable to the new role.

Highlight Your Software Expertise

Additionally, don’t forget to mention any technical expertise you may have acquired. Advanced Excel skills are highly marketable to accounting hiring managers.

Although many companies have accounting systems, much of the reporting is managed through data exports from the accounting system into databases and excel.

SQL experience is an additional plus to make your accounting resume stand out against other applicants.

You can highlight how you have or will use SQL to improve accounting processes, such as creating custom reports, making it easier to analyze data and identify trends.

This helps you make informed decisions and provide better business insights using accounting data. Additionally, SQL can also be used to automate workflows, streamline processes, and improve efficiency.

Format your Resume in a Professional Manner

Save your resume under a professional name. Including your first and last name in your resume file is a great starting point. You could also add your middle initial if you have a common name.

Additionally, if you send customized resumes to each position you apply for, include information such as the job title or the company name in your resume file name.

Keeping the entire file name, including file extensions and spaces, under 24 characters will make it easier for recruiters and talent scouts to scan.

Frequently Asked Questions

Consider these questions to help you tighten up your accounting resume.

What is a Resume Title for an Accountant?

A resume title is a title that gives a quick introduction of your qualifications and the overall goal of your resume.

An example title could be “Experienced Certified Public Accountant with 15 years of public accounting experience.

What is a Good Example of an Accounting Resume Objective?

A resume that highlights the desire to seek a higher position in any company and that also mentions the desire to contribute the person’s skills and attributes to better the company will always be welcomed.

Similar Resume Types to Reference

Accounting is a broad umbrella with a myriad of positions that are related. Consider these other resume types that incorporate accounting skills and experiences.

- Accounting Manager Resume: An accounting manager resume highlights leadership and management skills within an accounting department. An accounting manager understands full cycle accounting and can perform tax accounting duties and manage tax accounting processes.

- Financial Analyst Resume: A financial analyst reviews reporting and makes assessments of trends in transactions. They can assist tax accountants with generating reports and finding anomalies concerning tax balances. A financial analyst resume will reflect analytical and excel mastery.

- Finance Resume: Finance and reporting roles are similar to financial analyst roles. A finance resume strongly focuses on using systems for reporting, extracting data, and compiling reports and financial statements. They work closely with executive leaders to demonstrate the financial health of an organization.

Wrapping Up

Writing an accounting resume can be daunting, but there are several ways to make it stand out.

Start with a strong summary that focuses on your major achievements and echoes the skills listed in the job description. Show off certifications, experience, and data-driven accomplishments.

Following these tips will help you create an eye-catching and impressive accounting resume.